Corporate Governance

Principles-based oversight

Devon recognizes that sound corporate governance practices are necessary to maintain our social license to operate. We strive to establish a foundation for effective decision-making and risk management as we conduct our business in keeping with our corporate values and sustainability responsibilities, serving the interests of our stakeholders.

We’ve developed an effective corporate governance framework that evolves with our business. Forward-looking principles and practices guide our board of directors, executive management and workforce in making a positive and sustainable impact. Our Corporate Governance Guidelines support the long-term interests of the company and our stakeholders by focusing on certain core principles for effective governance of the company. The guidelines cover board composition, policies, procedures and committees. They also provide direction for the recruitment, selection, responsibilities, compensation and evaluation of individual directors. The guidelines are updated from time-to-time to reflect the evolving needs of our company.

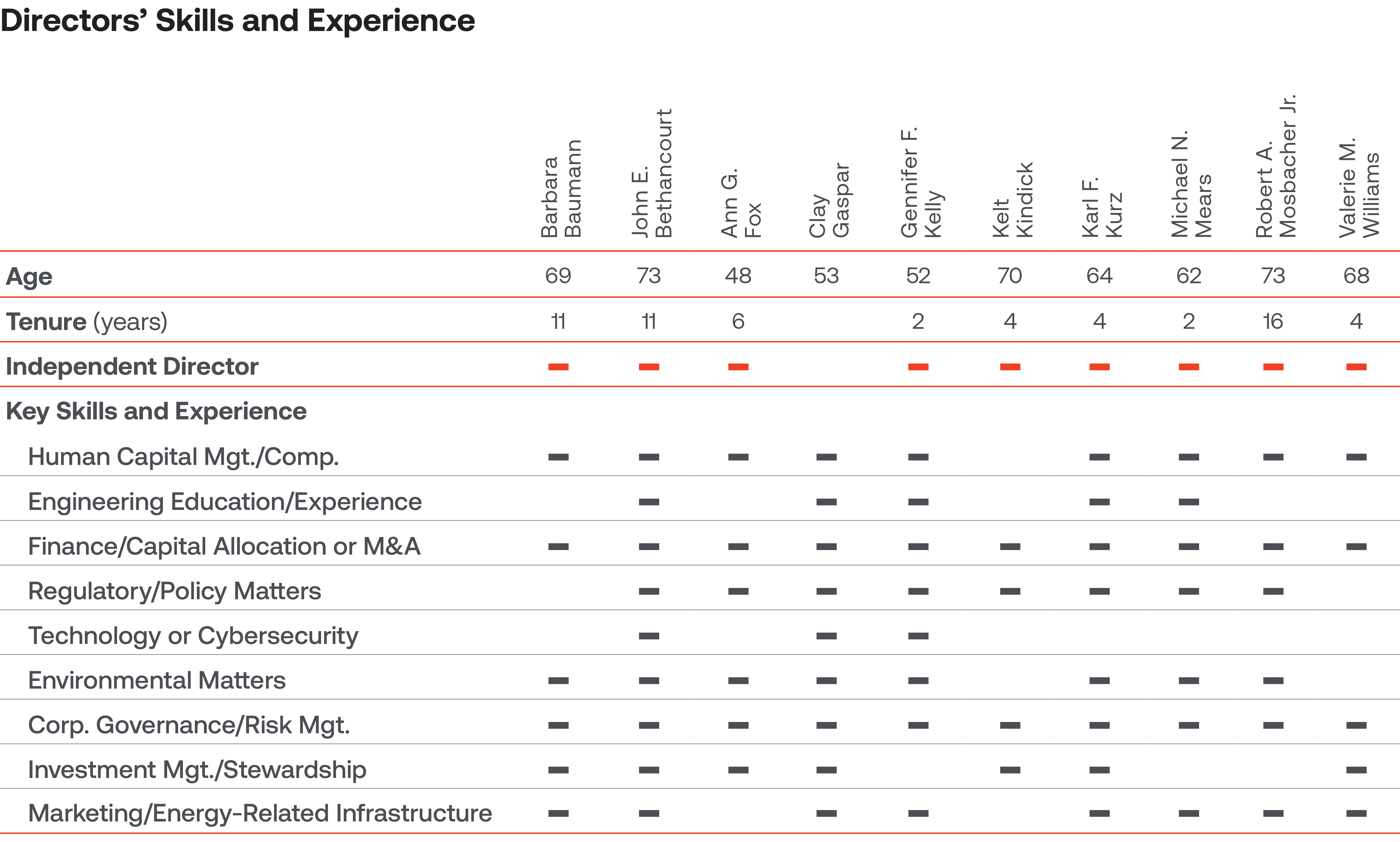

High-quality corporate governance requires that our board include members with an appropriate mix of skills and experience to oversee our business. In addition, we seek a high number of directors who qualify as independent based on New York Stock Exchange (NYSE) listing standards and Securities and Exchange Commission (SEC) regulations. As of October 2025, 10 of 11 (91%) of Devon board members qualified as independent.

Our board has a practice of separating the board chair and CEO roles. If our board chair is not independent, our board appoints a lead director who has duties, responsibilities and rights that support high-quality corporate governance. Regardless of whether our board is led by an independent chair or has appointed a lead director, the board seeks to optimize board performance through open, substantive communications among directors and between directors and management. Providing regular feedback, encouraging different viewpoints to be expressed and setting an expectation of constructive candor are hallmarks of our desire for frank and thoughtful board discussions.

The board’s Governance, Environmental and Public Policy (GEPP) Committee provides support for the board director appointment and selection processes described in our Corporate Governance Guidelines. Following a comprehensive candidate screening and review process and rigorous due diligence, the GEPP Committee recommends appointments and the board approves the appointments. This process enabled Devon to seamlessly manage the transition of our board chair position to John Bethancourt in July 2024, after former chair Barbara Baumann’s anticipated appointment as chair of a major institutional investment firm.

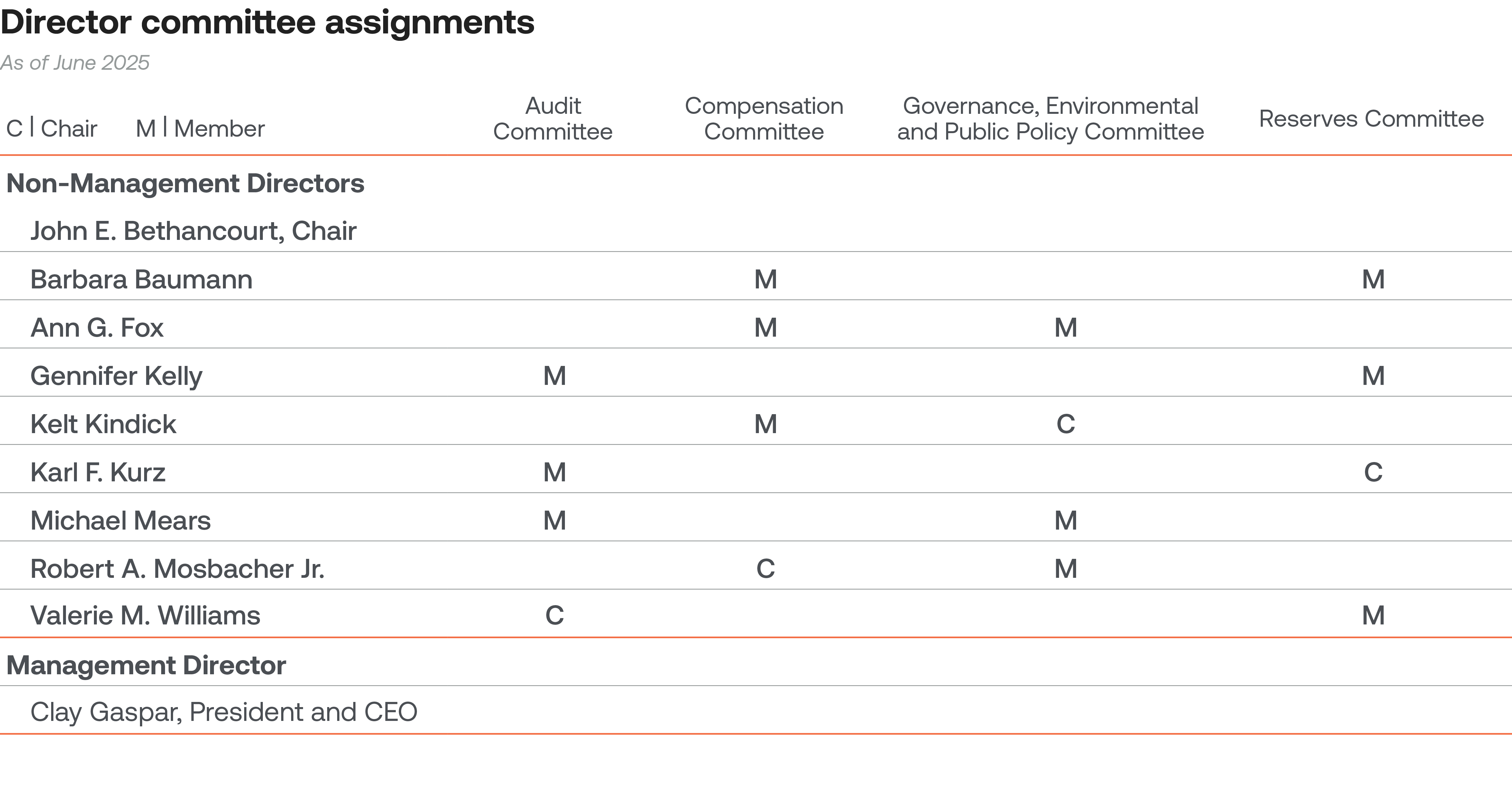

The full board has primary responsibility for risk oversight of the company, which includes reviewing whether Devon’s risk management is appropriate in relation to Devon’s material risks. Specific areas of risk oversight have been delegated to four standing committees: Audit, Compensation, SOAR and GEPP. All members of the GEPP, Audit and Compensation committees are independent, as required in our Corporate Governance Guidelines, and the members of the SOAR Committee are independent as well. Each committee reviews various aspects of Devon’s environmental, safety, governance, human capital management and community activities, metrics and reporting. The full board is involved in assessing our overall sustainability program.

Comprehensive discussions of relevant matters, including Devon’s business, operations, EHS and sustainability strategies, are part of our board meetings. The board often invites subject matter experts, external speakers, stockholders and thought leaders to board meetings and has incorporated a regular cadence for seeking information and insights from people outside the company, as well as internal subject matter experts. Among other things, the board in 2024 focused on strategy, including operational performance, safety and environmental targets, organic development of our assets and returns to stockholders.

The GEPP Committee has primary oversight responsibility for corporate governance, which includes identifying, reviewing and recommending the nomination of qualified candidates to Devon’s board. The committee’s scope also includes reviewing EHS performance and efforts to integrate sustainability into Devon’s business and activities. GEPP Committee members regularly hear from Devon leaders and subject matter experts on corporate governance issues and practices; emissions, targets and other environmental matters; sustainability-related stakeholder engagements; public policy developments; and our community and philanthropic programs. The GEPP Committee’s endorsement of high standards for sustainability-related performance helps inform the company’s strategy, plans and priorities, and secure internal alignment.

In 2024, the GEPP Committee’s activities included:

- Reviewing Devon’s strategy, performance and tactics related to the company’s environmental targets announced in June 2021. This included their implications for technology, operations, facility design, and capital and operational costs, as well as the potential impacts of our 2024 Grayson Mill acquisition on environmental performance.

- Receiving updates on policy matters impacting (or potentially impacting) Devon and discussing Devon’s and our trade associations’ engagement on such matters.

- Receiving Devon’s sustainability-related reporting prior to publication, including Devon’s 2024 Sustainability Report and Political Activity and Lobbying Report, and engaging with management on the content of this reporting.

- Reviewing and discussing Devon’s human capital management metrics and approach to cultivating a workforce with a range of experience, perspective and expertise. This included meetings with the Compensation Committee and management, reflecting the board’s continued belief in the importance of maintaining a workplace in which all employees feel seen, valued, heard and connected.

As sustainability and EHS performance have become more intertwined with operational and financial accounting matters, sustainability and EHS oversight has evolved to include other board committees as appropriate and additional discussions with the full board. For example, aspects of various proposed and new federal regulations, such as more stringent methane regulations, have been discussed by different committees of the board as well as the full board.

Board and Committee Evaluations

The board’s annual review process evaluates the effectiveness and performance of the board, the chair, the lead director (if applicable) and board committees. The evaluations are reviewed and discussed by the GEPP Committee, which also annually considers how to maximize the effectiveness of the process. The full board discusses the evaluations with and without management present.

Through the evaluation processes, feedback has been provided on a range of topics, including:

- board and management succession planning;

- agendas and materials for board meetings;

- the composition and structure of the board and board committees;

- the cadence and substance of discussions of Devon’s strategy, including the consideration of carbon management, infrastructure investments and business opportunities that are adjacent to Devon’s principal business of exploration and development of oil and gas;

- Devon’s EHS program and target-setting for safety and environmental performance; and

- the opportunity for outside speakers to present on certain topics at board meetings.

Devon’s board and board leadership consistently emphasize open communication among board members with a view toward building alignment on highly effective corporate governance of the company.

Board composition

Our decisions and actions have benefited from informed input of board members with a wide range of experiences, skills and backgrounds. Current nonmanagement board tenure of approximately 0-16 years provides a balance of fresh viewpoints and continuity. Our directors range in age from 48 to 73. Our board retirement age is 75 for non-management directors.

Board elections

Shareholders elect Devon directors at our annual meeting for one-year terms. Our bylaws require a director who does not receive a plurality of votes in an uncontested election to offer to resign, which has not happened in Devon’s 52-year history. At our 2024 annual meeting, our directors received an average voting support of 98%.

Executive and board compensation

Devon focuses on generating positive operating returns by managing a strong asset portfolio, delivering superior execution and exercising disciplined capital allocation. Our executive compensation program seeks to create a strong tie between company performance on these key objectives and executive pay. This pay-for-performance philosophy is intended to motivate near-term operational and financial success as well as to create long-term stockholder value.

Total compensation is weighted in favor of long-term incentives to emphasize value creation and stockholder alignment. Executive compensation is determined annually by the Compensation Committee, which evaluates the performance of the company and of individual executives and the business unit or organization they manage. At the start of each year, the Compensation Committee establishes companywide goals for the year that are used in awarding bonuses following the end of the year. The executive leadership team keeps the Compensation Committee apprised of performance on the goals throughout the course of the year.

The GEPP Committee nominates qualified candidates to be Devon directors, seeking qualities such as integrity and accountability, ability to provide informed judgment, respect from peers and high performance standards.

In determining executive compensation in 2024, the Compensation Committee considered the company’s operational and financial achievements and performance relative to our corporate goals. Devon set ambitious goals for financial results, capital expenditures, oil and gas production, safety and environmental performance. Our health and safety and environmental performance goals together accounted for 30% of the overall corporate scorecard, directly tying compensation to performance for the entire company.

Devon’s overall results in 2024 surpassed our company performance goals. Despite a decline in commodity prices, the actions our senior leaders took during the year led Devon to exceed our 2024 goals on many target metrics. Our 2024 oil production increased 8% compared to 2023. In addition, we delivered $2.9 billion of net earnings, operating cash flow of $6.6 billion and free cash flow of $3.0 billion. These results were due, in part, to operational outperformance, capital efficiency gains and the positive contributions from our Grayson Mill acquisition. We exceeded every goal for health and safety and the environment, including scores of 200% of target for SIF actual rate reduction and spill rate reduction, and 150% of target for both the methane emissions intensity reduction and methane emissions detection reduction. Based on our results, the Compensation Committee assigned a company performance score of 158%, which led to bonuses that were significantly above target for Devon employees.

The board determines non-management director compensation annually based on the Compensation Committee’s recommendations. As part of its annual due diligence of board compensation, the Compensation Committee obtains a report on the director compensation policies and practices of Devon’s principal competitors and other comparable companies. The Compensation Committee also considers the form and amount of director compensation. A meaningful portion of director compensation is conferred in the form of equity, which reflects the expectation that directors should have a significant stake in the performance of the company and thereby align their interests with those of our stockholders. Non-management directors are also able to participate Devon’s matching gift program that allows for qualifying charitable contributions of up to $10,000 annually. The matching gift program has been a popular new benefit offered at Devon with broad participation across the company.

To help ensure that management and our board understand the compensation issues that matter to our stockholders, Devon conducts investor outreach throughout the year. During 2024, the company contacted the majority of our top 100 stockholders, interacted with many other stockholders and met with stewardship representatives of numerous investors. The Compensation Committee and GEPP Committee review the feedback resulting from this outreach, as well as the most recent advisory vote by stockholders on executive compensation. At our most recent annual meeting of stockholders (2025), our executive compensation for the prior year received the support of 64% of shares voted.

Additional information about our executive compensation program is available in the Compensation Discussion and Analysis (CD&A) section of our 2025 proxy statement.